Strengthen Cash Flow Stability with Accounts Receivable Financing to Improve Liquidity and Business Growth

Boost cash flow with fast and flexible accounts receivable financing for stable and efficient business operations.

MIAMI, FL, UNITED STATES, December 10, 2025 /EINPresswire.com/ -- Many organizations today are turning to accounts receivable financing to stabilize their cash flow and reduce financial risk. As businesses face delayed payments, increasing operational expenses, and unpredictable market conditions, quick access to working capital has become essential.Traditional loans often come with long approval cycles and heavy documentation, making them less suitable for companies that need immediate liquidity. AR financing offers a faster and more flexible option that converts outstanding invoices into usable funds. This allows businesses to manage expenses, pay vendors on time, and support growth without accumulating additional debt.

Transform your payment workflows through smart accounts payable management

Get a Free Consultation. https://www.ibntech.com/free-consultation-for-ap-ar-management/

Growing Financial Challenges That Make Businesses Shift Toward Faster Cash Flow Solutions

1. Payment delays that slow down operational activities

2. Limited liquidity caused by long customer credit cycles

3. Difficulty funding daily operations during seasonal fluctuations

4. Cash flow gaps that affect vendor management and procurement

5. High administrative burden in tracking outstanding receivables

6. Limited access to traditional financing for small and mid sized firms

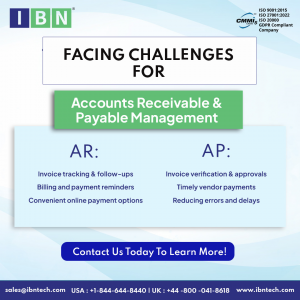

How IBN Technologies Provides a Reliable and Scalable Accounts Receivable Financing Solution

IBN Technologies delivers a structured and transparent accounts receivable financing model that helps companies access cash quickly while maintaining complete control over their financial operations. The company integrates financial expertise with advanced processing systems to support uninterrupted liquidity. Its AP and AR support extends to businesses seeking accounts payable outsource providers and industries that need specialized support such as construction account payable service for project based financial workflows.

IBN Technologies offers its AR financing solution through:

1. Fast evaluation of outstanding receivables to determine eligible funding

2. Transparent fee structures with no hidden charges or surprise deductions

3. Automated tracking of approved invoices and disbursed funds

4. Digitized documentation processes to reduce manual effort

5. Secure cloud based systems for complete visibility and audit readiness

6. Professional support teams that coordinate directly with clients to ensure smooth financing cycles

This model allows businesses to convert invoices into immediate working capital while reducing pressure on internal finance teams. The solution supports companies that face inconsistent payment patterns and need reliable cash flow to maintain operational stability.

Key Business Advantages of Choosing Accounts Receivable Financing

Organizations adopting accounts receivable financing benefit from faster access to funds, improved financial flexibility, and reduced dependence on traditional lending channels. Operational activities continue without interruption because working capital remains steady. Vendor payments become more consistent, improving overall relationships and reducing late payment penalties. Businesses gain better control over credit cycles, enhance their ability to negotiate favorable terms, and maintain a stable financial posture during periods of growth. This financing option also eliminates the need for collateral, making it ideal for small and medium sized companies looking to scale with confidence.

Why Accounts Receivable Financing Will Remain Vital for Future Ready Financial Strategies

As businesses grow, manage larger customer bases, and expand into new markets, accounts receivable financing will continue to serve as a dependable tool for sustaining liquidity. Companies are increasingly prioritizing speed, automation, and flexibility in their financial systems. AR financing supports these priorities by offering predictable funding, improved credit management, and stronger financial resilience. Organizations seeking long term financial stability can explore IBN’s flexible financing solutions by visiting the official website or requesting a consultation to better understand how AR financing can support their operational goals.

Related Service:

Bookkeeping Services: https://www.ibntech.com/free-consultation-for-bookkeeping/

About IBN Technologies

IBN Technologies LLC is a global outsourcing and technology partner with over 26 years of experience, serving clients across the United States, United Kingdom, Middle East, and India. With a strong focus on Cybersecurity and Cloud Services, IBN Tech empowers organizations to secure, scale, and modernize their digital infrastructure. Its cybersecurity portfolio includes VAPT, SOC and SIEM, MDR, vCISO, and Microsoft Security solutions, designed to proactively defend against evolving threats and ensure compliance with global standards.

In the cloud domain, IBN Tech offers multi cloud consulting and migration, managed cloud and security services, business continuity and disaster recovery, and DevSecOps implementation, enabling seamless digital transformation and operational resilience.

Complementing its tech driven offerings, IBN Tech also delivers Finance and Accounting services such as bookkeeping, tax return preparation, payroll, and AP and AR management. These are enhanced with intelligent automation solutions like AP and AR automation, RPA, and workflow automation to drive accuracy and efficiency. Its BPO Services support industries like construction, real estate, and retail with specialized offerings including construction documentation, middle and back office support, and data entry services.

Certified with ISO 9001:2015, 20000-1:2018, 27001:2022, IBN Technologies is a trusted partner for businesses seeking secure, scalable, and future ready solutions.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.